How strong is UK consumer appetite for personalised wellness? A PA

Consulting survey of 2,000 UK consumers found that

nine in ten want a personalised wellness product or service, with 67% specifically wanting personalised vitamins and supplements.

Perhaps most telling: 57% said they would share personal health data

with brands to enable better personalisation — a remarkable figure given

British cultural attitudes toward privacy. Despite this appetite, 50%

expressed dissatisfaction with current wellness products, suggesting a

market that's ready and waiting for genuinely effective personalised

solutions rather than more generic bottles promising everything to

everyone.

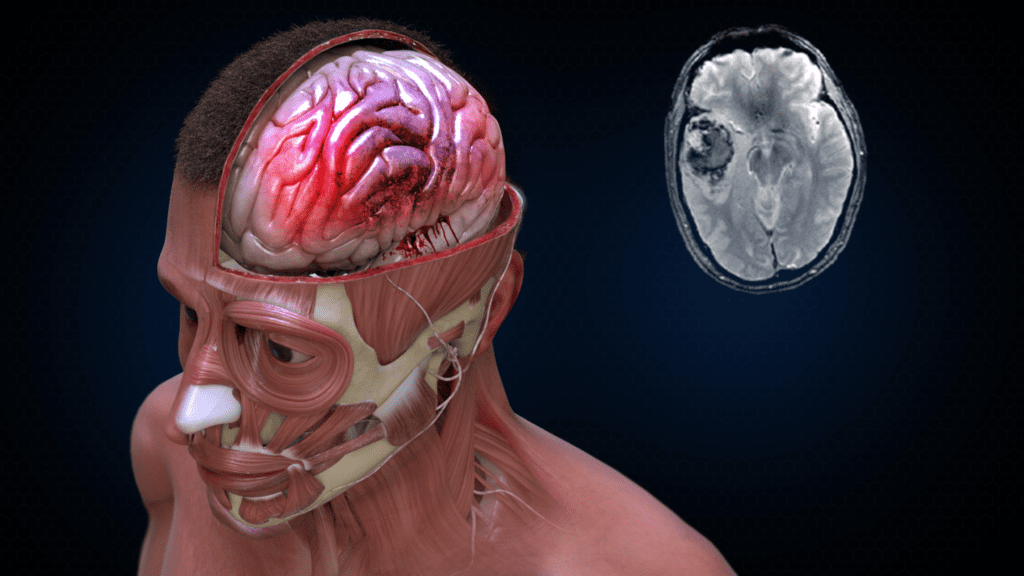

Advanced nootropics represent the shift toward targeted cognitive

enhancement

What are the UK's biggest retailers seeing in their data? The

Boots 2026 Beauty and Wellness Trends Report, published

on 12 February 2026 and drawn from data across 17 million active

Advantage Card holders, identified "Pursuit of Peak" as a headline trend

— consumers seeking optimised, personalised wellness. The report found

64% of UK adults now use AI search tools to guide health and beauty

purchases, whilst ashwagandha searches on boots.com surged

722% year-on-year. Grace Vernon, Head of Foresight and

Trends at Boots, stated: "Consumers are becoming increasingly educated,

informed and curious — not just about what's new, but what actually

works for them." This isn't niche biohacker territory anymore; it's

mainstream high-street behaviour, and

nootropic products

are riding this wave.

How is Holland & Barrett positioning brain health for 2026? The

retailer's 2026 trend predictions explicitly named

"Brain Wealth" as a defining macro trend, describing a

shift toward "personalised, science-backed routines aimed at building

long-term brain wealth." H&B reported growing demand for

next-generation nootropics, mood-balancing blends, and stress-reducing

adaptogens such as Bacopa Monnieri, with magnesium threonate for brain

support cited as a TikTok-driven trend. Magnesium was H&B's

most-searched ingredient of 2025, generating 8.5 million searches. The

retailer's framing of "brain wealth" — rather than just cognitive

performance — signals that brain-health education is becoming a consumer

priority, not just a marketing angle. Learn more about

Bacopa for memory enhancement

and

magnesium forms for brain health.

Are industry analysts backing this personalisation shift? David

Hamlette, wellness insights analyst at Mintel, told the

Business of Fashion that "personalisation and hyperspecificity

will become increasingly key for vitamin and minerals brands from 2026

all the way through 2030." Olivier Garel of Unilever Ventures declared

that "2026 will be defined by the rise of precision wellness" — a highly

personalised health approach using genetic, environmental, and lifestyle

data to create tailored strategies. McKinsey's Future of Wellness

survey, covering 9,000 consumers across the US, UK, Germany, and China,

found that 79% of UK consumers now consider wellness a

"top" or "important" priority, with clinical effectiveness the top

purchasing factor for roughly half of respondents. Data-informed

wellness isn't coming — it's already here, y'know? For evidence-based

supplement guidance, explore our

best natural nootropics guide.

UK Consumer Personalised Wellness Demand (2026)

Want personalised wellness

Want personalised vitamins

Use AI for health decisions

Data sources: PA Consulting, Boots, McKinsey Future of Wellness survey